PayID allows users to send money with quick identifiers like an email address or a phone number. It relies on strong security standards for quick and easy transactions.

WHAT IS

PAYID?

PayID is a modern payment solution, established by the New Payments Platform Australia (NPP). To transfer money, customers need to use a unique identifier like an email, phone number, or ABN (for businesses). No need to enter bank details, which reduces the checkout time.

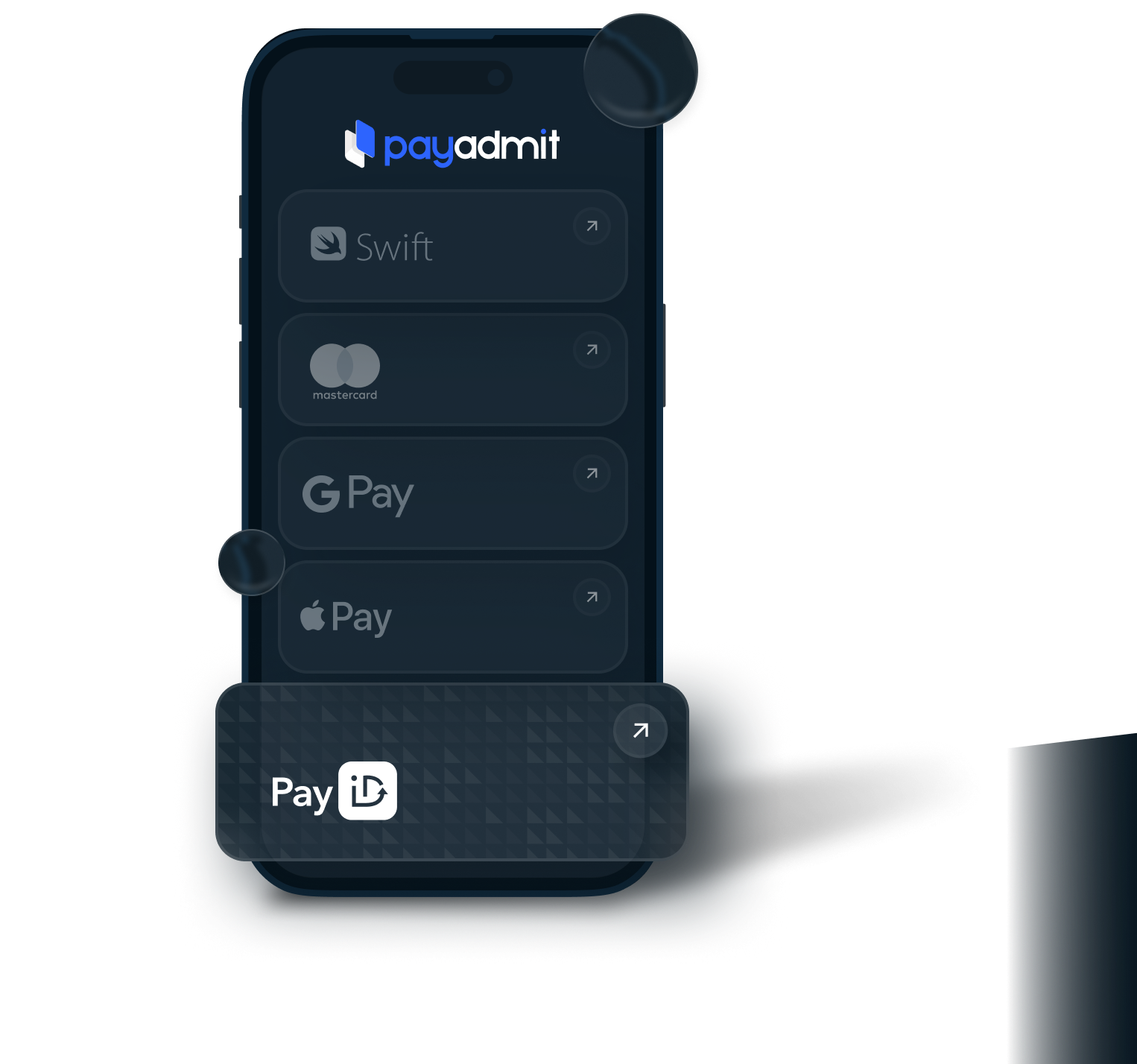

The PayID payment gateway has strict policies for added security and legal compliance. It can be conveniently integrated into your business through PayAdmit.

PayID features

WHERE TO USE

PAYID?

PayID is widely popular among e-commerce companies, which need to manage secure transactions across Australia. It’s supported by 100+ local banks and financial institutions. Users can send or receive payments using simple identifiers in mobile banking apps and online platforms. Merchants that want to receive a payment simply provide customers with the identifier that’s linked to their account.

KEY FEATURES OF

PAYID

Local market reach. Helps merchants approach the target audience in Australia.

Strong security. Protects personal data through data encryption and active monitoring for possible misuse.

High accuracy. Uses identifiers to reduce the chances of making any mistakes.

Quick transfer. Make transactions within minutes at any time of the day.

High cash flow. Improves business flow and enhances customer experience.

FREQUENTLY ASKED QUESTIONS

Why should your business use PayID?

Is it safe to send money using PayID?

Yes, P2P transfers are safe when using reputable platforms with encryption and authentication mechanisms. Transactions are often irreversible, which makes users verify recipient details and avoid sending money to unknown parties.

Which countries and currencies are supported by the PayID payment gateway?

PayID is available only in Australia, supporting transactions in Australian Dollars (AUD).

How much time is required to employ PayID through PayAdmit?

It may take around 3 days to employ the system within your business through PayAdmit.

Can you employ PayID along with other providers through PayAdmit?

Yes, PayAdmit can help your company integrate this payment solution along with other methods.

Does PayID manage refunds and chargebacks?

Refunds for PayID payments can be managed via API or through the Dashboard. The system does not have traditional chargebacks. Transactions can’t be reversed by default once settled.