The system enables secure payments between banks worldwide. It helps senders and receivers have better control over transferred funds, which is perfect for e-commerce.

WHAT IS

OPEN BANKING?

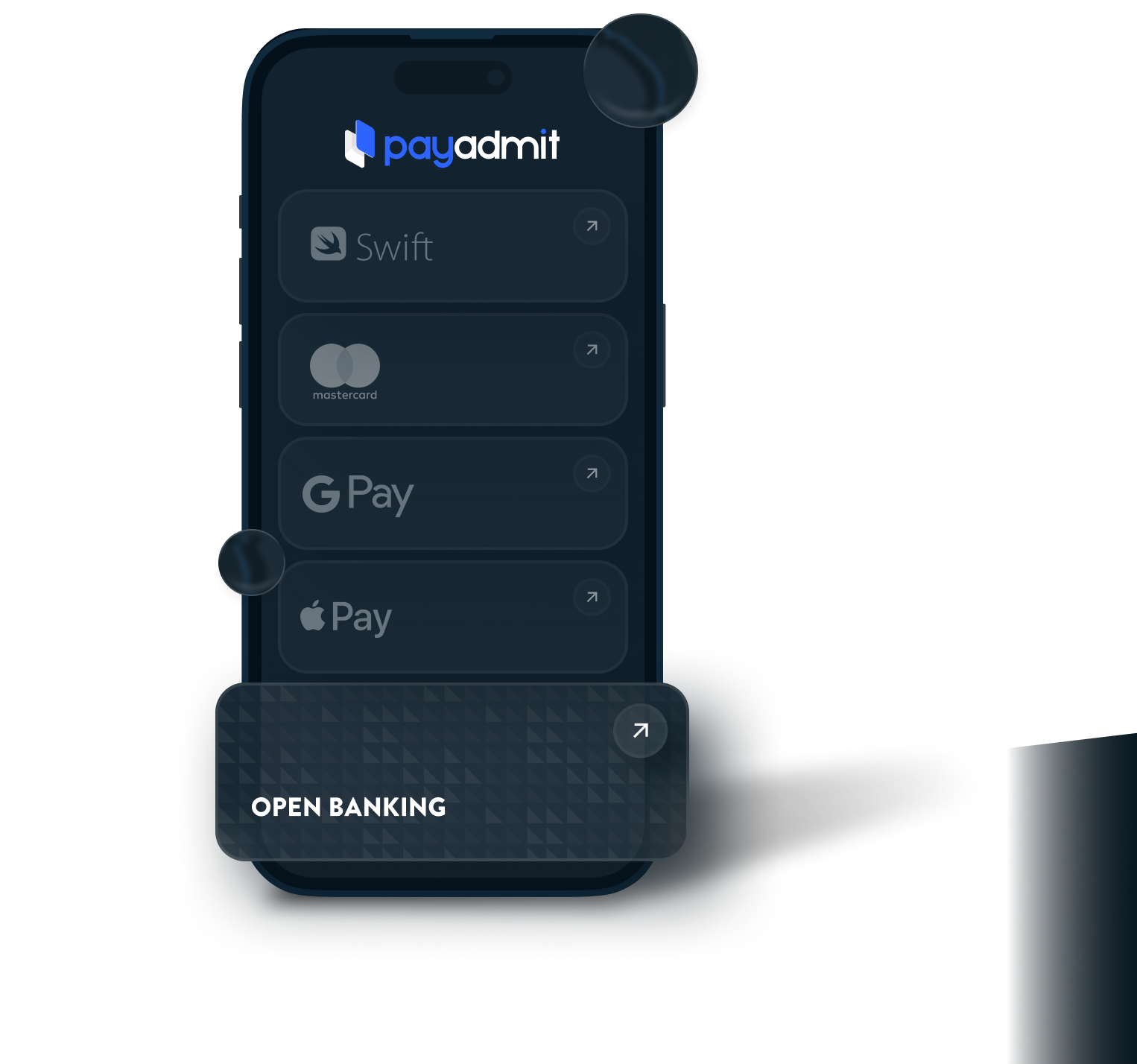

Open Banking is a payment method that gives users full control over their own financial data. It helps businesses integrate with multiple banks under common regulations. Commercial companies get a chance to speed up money transfers and raise conversions.

The Open Banking payment gateway is based on standardized security protocols. It forces commercial companies to comply with legal regulations. Contact PayAdmit for quick integration into the business platform.

Open banking features

WHERE TO USE

OPEN BANKING?

Open Banking is accessible in 70 countries, which makes it a perfect choice for foreign businesses. Widely used in e-commerce, it helps potential clients make their purchases anytime, anywhere. The method can be easily integrated into an international network, enabling cross-border transactions.

KEY FEATURES OF

OPEN BANKING

Market reach. Helps merchants enter new markets, enabled by local fintech companies.

Strong security. Protects sensitive data through strict authentication.

Customer personalization. Offers customized financial services, enabled by sensitive data.

Optimized payments. Enables quick transactions that improve cash flow management.

Automated operations. Allows merchants to use APIs to automate the mechanism of matching invoices to money transfers.

FREQUENTLY ASKED QUESTIONS

Why should you use the Open Banking payment gateway?

Is it safe to transfer money using Open Banking?

Yes, it is safe to transfer money this way. The system uses a strict authentication mechanism and APIs managed by financial regulators. It completes only verified transactions to reduce illegal operations.

Which countries and currencies can be used via Open Banking?

The system is represented in 70 countries, like the UK and the USA. It manages transactions in EUR, CHF, GBP, USD, and other currencies.

How much time do you need to install Open Banking through PayAdmit?

It takes approximately 3 days to install the method within your business through PayAdmit.

Can you integrate the Open Banking payment gateway next to other providers?

Yes, PayAdmit can help your company integrate the method along with others.

How does Open Banking deal with refunds and chargebacks?

Refunds take up to 10 days since the incoming card payment should land in the merchant’s account before it can be reversed. Chargebacks are not processed by the system.